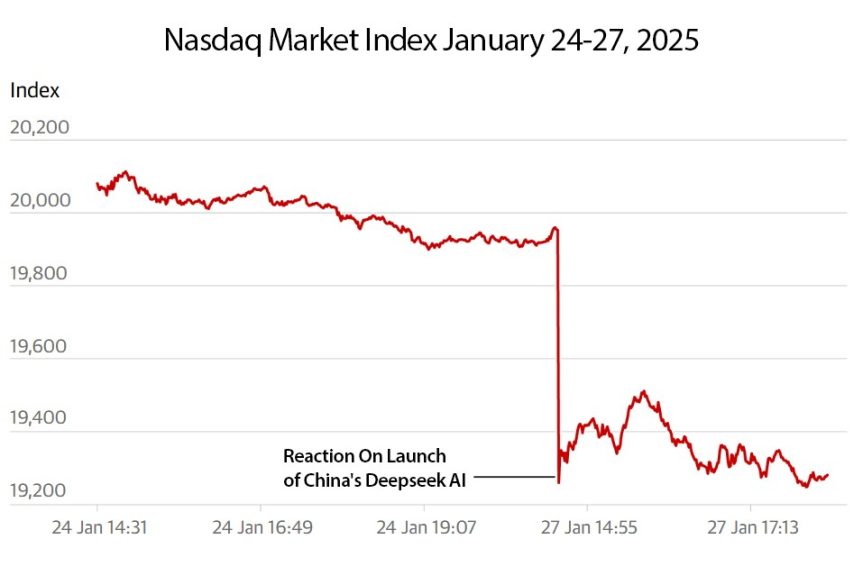

US stocks lost over US$1 trillion overnight (January 27) as China’s High Flyer, a Hedge Fund in Hangzhou, launched its Chinese chatbot, named ‘Deepseek’. The app appears to offer the same facilities as the US developed OpenAI and its ChatGPT tool, and the same performance but with fewer resources. Deepseek has already overtaken ChatGPT as the most-downloaded free app on the iOS App Store in the United States.

The United States has sanctioned the Chinese tech industry to deliberately hinder its AI capabilities, banning the export of US microprocessors and chips to China since 2022. On the launch of Deepseek, which has coincided with the auspicious time of the Chinese New Year, (2025 is the Year of the Snake) the US company Nvidia, a leading maker of the computer chips that power AI models, lost nearly US$600 billion from its market value. Google lost US$100 billion and Microsoft US$7 billion.

US analysts are now questioning the US AI development model, with suggestions that it is far too expensive. This raises doubts over the necessity for hefty investment in AI infrastructure such as chips and the market-leading role of US tech companies in AI, which in turn threatens to put American tech sector valuations under pressure. US companies have invested over US$1 trillion over the pasts few years to develop and maintain superiority in AI systems, and especially over China. DeepSeek claims its R1 system cost US$5.6 million to develop, compared with much higher estimates for western-developed models, although experts have cautioned that may be an underestimate. Last year Dario Amodei, the co-founder of leading AI firm Anthropic, put the current cost of training advanced models at between US$100 million and US$1 billion.

These overnight market losses have spread to other Western, US-friendly supply chains, with all major European technology stocks down. The Dutch chipmaker ASML slid by 7%, while Germany’s Siemens Energy, which provides hardware for AI infrastructure, was down nearly 20%, while France’s digital automation company Schneider Electric fell by 9.5%. The Japanese chip companies Disco and Advantest – a supplier to Nvidia – suffered declines of 1.8% and 8.6% respectively.

The Deepseek incident has been described as the US tech industries version of the ‘Sputnik’ moment, where the Soviet Union stunned the United States by putting the first satellite in orbit in 1957. What is interesting about Deepseek however is that contrary to the United States, it is an opensource developer, meaning that unlike most US models it is freely available, meaning the private sector will be able to play around, explore with it and further develop it.

DeepSeek is also focused solely on research and has no detailed plans for commercialization, allowing its technology to avoid the most stringent provisions of China’s A.I. regulations, such as requiring consumer-facing technology to comply with the government’s controls on information. That said, the Chinese government will be well aware of the issues at stake – it has allowed Deepseek to release a product that at least indicates that the US AI development is now limited in terms of sheer development cost. In permitting its release and sharing that, it is also stimulating competition against United States AI technologies on a global basis. China also has an oft-forgotten linguistic development advantage – far more people speak Chinese than English.

This technology also includes Russia, whose chatbot industry includes Gigachat, developed by Sberbank, and is the largest Russian-language service. Launched in February last year, it has several million users. Gigachat has become very popular in Russian-speaking countries, essentially accounting for most of Eurasia.

YandexGPT has been developed by Russia’s Yandex LLC and is also poised to ‘make Open GPT seem mundane’.

The Deepseek launch however has democratized the global AI services industry and illustrated that there are highly viable alternative development models that can compete with and potentially overtake the capabilities of Western-financed products. China has already made the Deepseek system opensource, meaning Russian scientists can study it, and in collaboration with Chinese scientists continue to take capabilities forward. Added into this mix is India, whose own AI and Chat facilities are also fast-developing and providing services to a market of 345 million Hindi and 237 million Bengali speakers.

What hasn’t been factored into the development equation by US investors hoping to corner the global AI and chat markets are the sheer linguistics – with opensource and significant University recruitment of the brightest and best in these categories all being sought. In terms of the English language, some 380 million people globally speak the language upon which most US tech is built on.

However, 941 million people speak Mandarin Chinese, a combined 582 million speak the combined two major Indian languages, while another 258 million speak Russian. In South America, 200 million people (mainly in Brazil) speak their version of Portuguese, and a further 300 million South Americans speak their version of Spanish. There are 450 million Arabic speakers. Those very basic statistics equate to an English-language development pool of 380 million versus a BRICS language development pool of over 2.7 billion. That implies a huge development advantage over and above English-language (read American) tech and AI developments.

This pooling of resources is exactly what is happening with Russia and the BRICS group, where over 20 companies from six of the bloc’s member-states (Russia, China, India, Brazil, Iran and the UAE) have already formed a BRICS+AI alliance. In Russia’s case, RDIF, the sovereign wealth fund has invested in this alliance which also includes BRICS universities, medical companies, pharmaceutical developers, financial infrastructure developers, telecommunications innovators, and electric batteries and semiconductor manufacturers. The focus is on digital technologies in the public and commercial sectors.

Russia also has ambitious plans to integrate AI across its economy, targeting an AI contribution of 5% to its GDP by 2030 and training 80% of its workforce in AI skills. The BRICS+AI alliance could mark a turning point in Moscow’s technological aspirations – and especially now that China has launched Deepseek as a very specific challenger to the US based, English-language development platforms – and made it available for BRICS (and other emerging countries) to share.

Further Reading

Russia’s Sovereign Wealth Fund Invests In A BRICS+AI Alliance

Русский

Русский